|

|

29th December 2012 |

Pent up demand to drive upsideShiv Puri

|

|

|

- As in the previous cycle in India, government inaction and poor policies suppress demand, choke supply and cause cyclical inflation with twin deficits, but they do not cause demand destruction. Demand simply gets pent up and releases into the economy when conditions improve.

- In 2003, when pent up demand got released into the economy; the positive leverage to earnings was huge and the stock market went up 100% from valuation levels similar to today.

|

|

The current problems plaguing India are virtually all self-inflicted. The ineffective governance, lack of policy direction, high inflation, twin deficits, all mixed with a financial crisis. The exact scenario was prevalent in India during the 1997 – 2002 time frame in the backdrop of the Asian financial crisis. The one significant difference this time is that corporate leverage in India is much lower now (debt/equity of 0.5x) versus then (debt/equity of 1.2x).

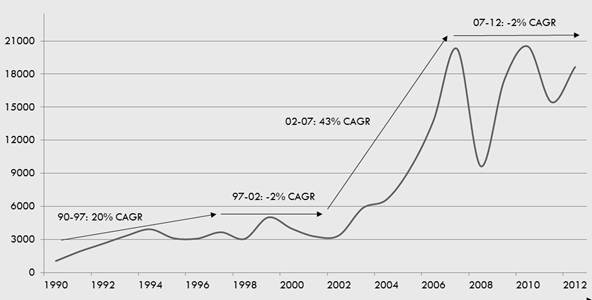

Figure 1: Alternating 5 –6 year cycles of strong returns followed mediocre returns.

As is evident from figure 1, during 1997-2002, the market went nowhere just like it has gone nowhere in the last 5 years. In 2001, the government unveiled a series of reforms that got the economy going. These included: i) phased deregulation of petroleum prices; ii) setting up of a Central Electricity Regulatory Commission; iii) establishment of Disinvestment Commission to sell stakes in state owned companies; iv) increase in infrastructure financing; v) opening up the insurance, telecom sectors for private and foreign players to compete. Over the last nine months, the government has done the same and these actions are not insignificant. The key one in my view is that they raised prices of most regulated items such as coal, power, petrol, diesel, railway fares by 20%-50% and made them market linked for the future. (Recall, fuel subsidies is a big source of the fiscal deficit.) While all of this has caused some short term pain, the long term benefits of lower subsidies and market linked prices cannot be overstated. In addition the government has opened up the retail and aviation sectors to foreign investors, addressed the coal shortage issue faced by upcoming power plants, and started work on the freight corridor project (please read appendix a). But all of this will show up in the economy after a lag.

As in the previous cycle in India, government inaction and poor policies suppress demand, choke supply and cause cyclical inflation with twin deficits, but they do not cause demand destruction. Demand simply gets pent up and releases into the economy when conditions improve. This is largely because of rising aspirations of a growing middle class, low penetration rates of virtually all products, a healthy (30%) savings rate and many productive infrastructure investment opportunities. In 2003, when pent up demand got released into the economy; the positive leverage to earnings was huge and the stock market went up 100% from valuation levels similar to today.

|

|

Disclaimer: This material contains the opinions of the individual and such opinions are subject to change without notice The information contained on this website is provided for information purposes only and does not constitute or form part of and should not be construed as an offer to sell or an invitation to subscribe or any invitation to offer to buy or subscribe for any securities. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

|

|